Have you bought some bargains online this week? We’re all shopping online much more these days. We’ve been forced to because of the pandemic – and it’s been a lifeline to many. But when does it become a problem? Do you use ‘retail therapy’ to make yourself feel better? Do you ever worry that you’re addicted to online shopping? Compulsive shopping has psychological causes and consequences. Here’s why – and how to stop online shopping addiction.

What is online shopping addiction?

Shopping addiction is a modern phenomenon. ‘Compulsive buying disorder’ was first described in the early 20th Century. Online shopping is more recent still. And it’s very easy to overspend online – especially at this time of year. With Black Friday, Cyber Monday and Christmas approaching, we’re actively encouraged to! But what makes online shopping addiction potentially more dangerous – like online gambling addiction – is the always-on easy availability of a fix. No need to put on your coat and go down the shops – your shopping hit is just an ‘add to basket’ click and a credit card away.

Whether compulsive shopping is done online or in real life, the same psychological factors are at play. It’s an ‘impulse control’ behavioural addiction like many others. Compulsive shopping is a way to feel good and avoid negative feelings, such as anxiety and depression. It affects more women than men – 80% according to one study.

What makes shopping a different addiction to drink, drugs or gambling is that it often seems a fairly benign and socially acceptable compulsion. After all, we all have to shop. And, in our consumerist society we’re constantly bombarded with advertising messages and told to buy stuff we don’t need. Yet shopping addiction carries with it the same risk of potentially damaging outcomes – to your finances and your mental health.

Psychological reasons for overspending

Treating ourselves now and then and indulging in a bit of ‘retail therapy’ can be a good thing, and give us a boost. But it can also become problematic. Shopping becomes an unhealthy coping mechanism when it’s used to manage difficult feelings, such as sadness, loneliness or stress.

When we’re considering buying something new, we get a rush of dopamine – the neurotransmitter in our brain that plays a big role in the reward system. It provides us with immediate gratification, and a temporary relief from difficult feelings. But temporary is the key word here. It’s not a long-term strategy, and can land us into trouble if we begin spending beyond our means.

Emotional spending – what are your triggers?

The first step to overcoming your online shopping habit is to understand emotional spending – and your triggers. What emotions precede your spending sprees? Common ones include:

- Jealousy. You may not covet your neighbour’s ox these days – but you see plenty of images to spark jealousy online. All those images in your Instagram feed of people apparently having better lives – and better stuff – than you. But you don’t need to keep up with the Joneses. Jealousy can be useful as it might reveal what’s important to you. But try simply to notice and reflect on the feeling – rather than get your credit card out.

- Guilt. If you feel you’ve failed at something, or wronged someone, do you try to make yourself feel better by buying something? One thing that might make you feel guilty is a shopping spree – so this can lead to a vicious cycle. Instead, try to reflect on your feelings of guilt, whether they’re justified, and how you can improve (if necessary).

- Fear. Do you use shopping to distract yourself from feelings of fear, anxiety or nervousness? Can you meditate, do some breathing exercises or go for a walk instead?

- Sadness. Do you buy things to boost your mood, and cope with feelings of sadness or depression? Buying something new can give you a rush of happy hormones for a while. But it wears off – unlike the dent in your bank balance.

- Loneliness. If you feel lonely or isolated, it can be tempting to cheer yourself up and distract yourself from your uncomfortable feelings by buying something.

- Boredom. This was a big one for many people during lockdowns. Online shopping was the only way to shop – and, for many people, there wasn’t much else to do. But shopping is an expensive way to overcome boredom.

- Achievement. Not all emotions that can trigger your online shopping are negative. Have you achieved an important goal? Is your first impulse to treat yourself to that new laptop or pair of shoes you’ve had your eye on? Can you actually afford it – or are you storing up more problems for the future? Is there another (cheaper) way to reward yourself?

Which of these resonate with you? If you can identify your triggers, this will help you substitute shopping for something else instead.

How to stop online shopping addiction – 10 strategies to curb your spending

The following tips are a mix of emotional and practical strategies. See which ones work for you.

- Be clear about your motivation. Whenever you want to break a habit and create lasting change, start with motivation. Ask yourself: why do you want to cut down on your online shopping? Is it because you want more disposable income, or it’s leading you to feel stressed, guilty or anxious? Whatever it is, get clear on your ‘why’.

- Make a plan. Develop a clear, actionable plan. Identify all the areas where you’re over spending. Once you’re clear on why you’re doing something, what your triggers are, and how you’re going to change it, putting the plan into action becomes much easier.

- Keep a spending diary. For one month, write down everything you buy, in a notebook or on your phone. Jot down any emotions you were feeling too. This will help you identify patterns of spending – and your triggers. Reflecting on your spending at the end of the month may also be quite sobering!

- Delete shopping apps. Always shopping on your phone? Consider deleting those shopping apps! Or at least ‘offloading’ your apps back into the cloud, so that, in order to shop, you have to download the app again. This may give you enough of a pause to stop your shopping habit in its tracks.

- Unsubscribe from email newsletters. While you’re at it, unsubscribe from those emails with special offers and enticements to buy stuff too. This removes another cue from your online environment that could trigger another online shop.

- Take a pause. If you feel the impulse to buy something, you don’t have to do it right away. If there’s something you really want, try to leave it a week before buying it – then see if it still seems so important. Make a list of pros and cons for big purchases, so your decision is a well-considered one and not just an impulse.

- Keep a gratitude journal. This can be helpful if jealousy is one of your triggers. Each morning, write down five things you’re grateful for. Focus on what you have, rather than what you don’t.

- Find cheaper rewards. It’s great to practice self-care and treat yourself from time to time. But does that have to involve spending money? Can you find a new hobby, take up a sport, go for a walk, catch up on that TV series, read a chapter of your book? Anything that makes you feel good – but doesn’t break the bank!

- Connect with your values. What’s important to you? What kind of person do you want to be? Think about what you really want out of life. This will help you focus more on your deeper and longer-term goals – rather than shopping-based quick fixes.

- Be kind to your future self. A shopping spree might make you feel better short-term – but spare a thought for your future self, who will have to pick up the bill. Reflect on how you’ll feel once the shopping buzz wears off. And the impact today’s shopping today will have on your future financial goals.

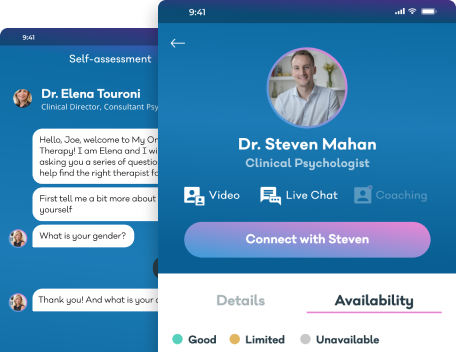

If you’re concerned about your online spending, these strategies are a great place to start. But if you commit to doing all of the above but you’re still struggling to cut back, it might be worth digging deeper to explore whether your shopping is serving any kind of psychological function. Are you using shopping as a coping mechanism to deal with difficult emotions? Therapy can help you get to the root of the issue.

Get Self-care free for a month

We’re not asking you to buy anything from us this Black Friday! Instead, we’re offering a completely free one-month subscription to our Self-care courses. Sign up using the code BLACKFRIDAY to get a month’s access to audio courses and exercises, written by our psychologists, on topics such as depression, anxiety and addiction.